The ATO recognises that a number of residential building components have a shorter life than the main structure of a building and as such can be written off at an accelerated rate.

These assets are often referred to as ‘plant and equipment’, Division 40 or ‘wear and tear’ items and can be claimed as depreciable assets provided the:

- Property was first available for lease BEFORE 09 May 2017

- Property is NEW and unused at the start of lease

- Item has been purchased new and unused after 9 May 2017

- Owner operates as a registered COMPANY (but not just as a Trustee of a SMSF)

- Owner operates a BUSINESS of property investment (subject to ATO criteria)

- Property is a COMMERCIAL property

Deferred Assets

In the instance that the asset was purchased with a ‘second-hand’ residential property after 9 May 2017, the ATO will still allow you to claim the loss in value of these assets but not until you sell the property. To make sure that you are claiming every item allowable, ACP Quantity Surveyors are leading the way by providing clients with ‘Deferred Asset Schedules’ as a standard inclusion.

At this point the loss in value of these deferred assets may be considered by your accountant when calculating any Capital Gains adjustments.

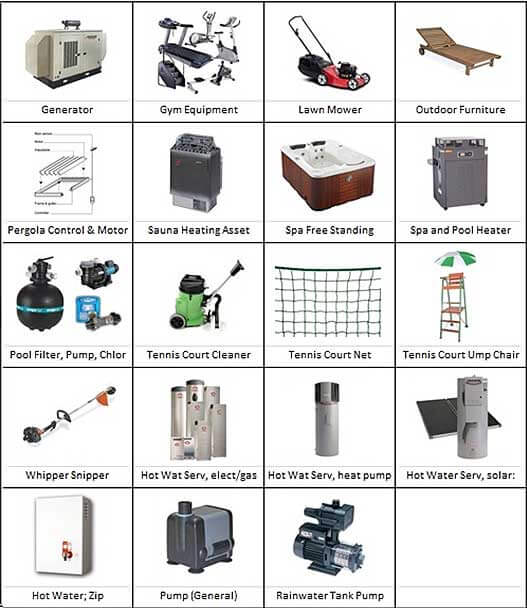

Subject to the above, these items, claimed under Division 40 of the income Tax Act, have been represented pictorially as follows: